Automated transfers, instant tracking, and structured financial control.

Automated Payouts

Enable seamless, large-scale payouts directly from your platform with secure APIs. Instantly transfer funds to vendors, partners, or employees without logging into a bank eliminating manual uploads and ensuring faster settlements and better cash flow visibility—all in one automated process ensuring all your financial operations are seamless.

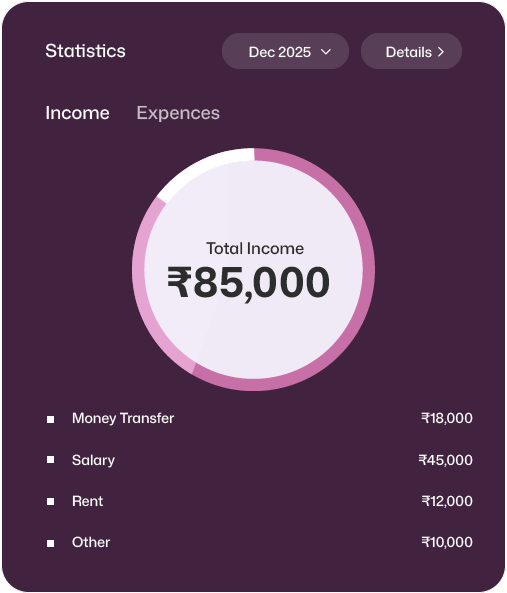

Transaction Tracking

Monitor every financial movement in real time using advanced API integrations. Get instant visibility into account balances, transaction statuses, and reconciliations. This enables better financial control, quicker issue resolution, and transparent reporting—empowering businesses to manage operations with confidence and precision.

Virtual Accounts

Generate dedicated virtual accounts for customers, partners, or vendors effortlessly. Automate collections and reconcile payments without manual oversight. Simplify accounting, reduce human error, and gain detailed insights into inflows and outflows with real-time tracking and structured financial mapping for better and easy money transaction.

Building Smarter Banking With Automation

Power your platform with integrated, code-driven financial automation.

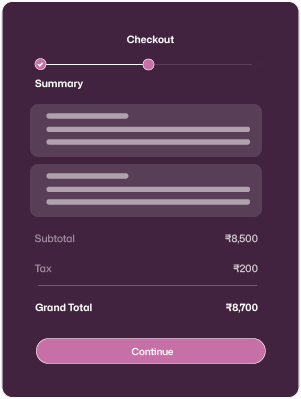

Bulk Operations

Execute large-scale financial transactions effortlessly through API-enabled automation. From vendor payouts and employee salaries to customer refunds, handle thousands of transactions securely and instantly while improving operational efficiency.

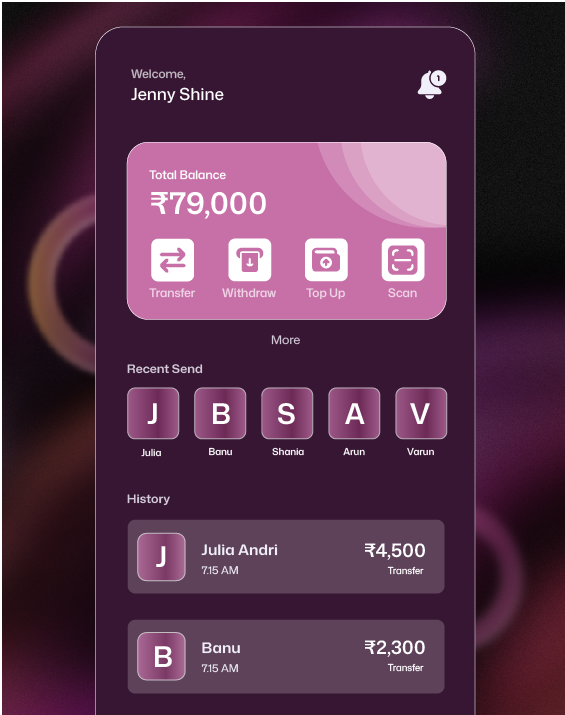

Wallet Management

Simplify multi-wallet operations with seamless API integration. Easily create, monitor, and manage digital wallets for various use cases like customer balances or cashback programs ensuring accuracy, compliance, and enhanced fund control.

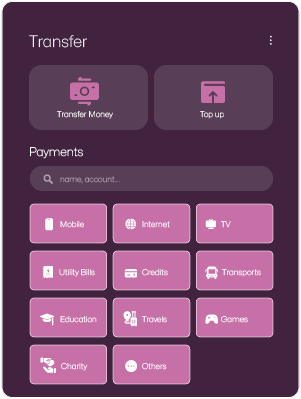

Payment Automation

Automate every aspect of financial disbursement without manual intervention. Whether managing marketplace vendor settlements or recurring payments, our APIs ensure traceable transactions empowering your business to scale faster.

Simplified APIs For Effortless Onboarding

Setup Access

Begin by generating secure API keys through your Dashboard and review the documentation for authentication and permissions. This ensures your integration is verified and ready for sandbox testing to establish trusted connections.

Integrate APIs

Connect the onboarding APIs within your system to automate merchant creation, verification, and activation. The integration eliminates manual data entry, simplifies KYC processing, and accelerates approvals—ensuring a faster transparent onboarding.

Deploy & Monitor

Once testing is successful, switch from sandbox to live mode to begin real merchant onboarding. Monitor performance metrics, handle responses efficiently, and track every onboarding status enhancing operational reliability and ensuring data accuracy.

APIs Powering Every Business Model

Need Help? Start Here...

APIs act as the foundation for fintech startups aiming to build modern financial tools. Whether it’s automating lending, creating wallets, or enabling secure digital payments, our API suite accelerates product launches, enhances scalability, and gives startups enterprise-level capabilities without traditional banking complexity.

APIs streamline complex transactions for online sellers and marketplaces. From vendor settlements and refunds to customer payments, our platform automates financial flows in real time. This enables e-commerce brands to manage thousands of transactions effortlessly while improving accuracy, reducing delays, and providing better customer experiences.

Large businesses leverage APIs for advanced treasury management, cash flow visibility, and instant bulk transfers. Our system integrates directly into ERP and CRM platforms, helping enterprises automate internal and external payments while ensuring compliance, audit readiness, and continuous optimization of financial operations at scale.

Fortifying Finance With Smart APIs

Encrypted Infrastructure

Our APIs are built on multi-layered encryption protocols that safeguard every transaction and data exchange. Every API request and response is protected end-to-end, ensuring uncompromised security and confidentiality throughout the integration lifecycle.

Verified Authentication

Each API access is secured through token-based authentication. This ensures only verified systems can interact with your data. Developers gain control, minimizing unauthorized access by maintaining connectivity between your platform and banking networks.

Compliance Assured

Our infrastructure adheres to top-tier industry’s compliance frameworks and protocols. This means your financial operations meet regulatory expectations while maintaining data integrity, user privacy, and full transparency across every interaction.