Seamless Business Banking

A current account built to support high-volume transactions. Manage collections, payouts, and settlements effortlessly in one place.

Instant Access To Your Funds

Faster Payment Settlements

Receive customer payments directly into your current account. Enjoy quicker settlements that improve cash flow and working capital.

Enhanced Transaction Security

Advanced security protocols protect every transaction. Ensure safe, compliant, and reliable payment processing for your business.

Real-Time Tracking & Control

Monitor transactions and balances in real time. Gain complete visibility over your incoming and outgoing payments.

Easy & Reliable Integration

Connect your current account effortlessly with our payment solution. Simplify collections, refunds, and reconciliation through automation.

Your Everyday Business Banking Companion

One Account, Total Control

Manage payments, settlements, and payouts from a single current account. Simplify operations and focus on growing your business.

Quick Access to Funds

Enjoy faster settlement cycles with no unnecessary waiting. Keep your cash flow steady and predictable.

Trusted Security Framework

Enterprise-grade security safeguards every transaction. Process payments confidently with a reliable banking partner.

Simplifying How Businesses Bank Daily

Virtual Collections

Use dedicated virtual accounts to track payments instantly and automate reconciliation.

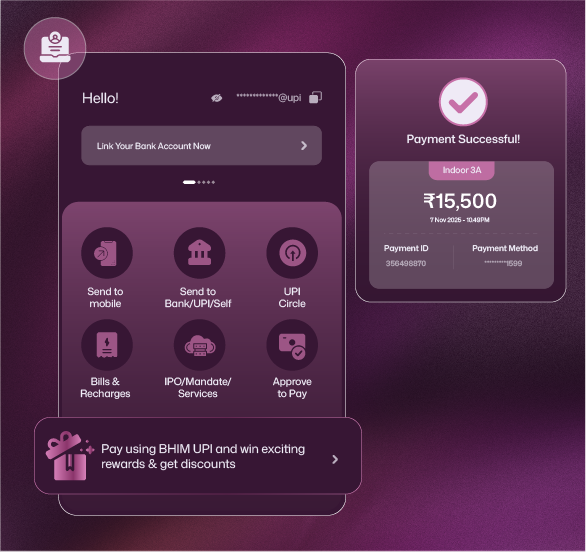

UPI Collections

Collect instant payments with unique UPI IDs—quick, secure, and seamless.

Digital Onboarding

Open your current account online with quick KYC and start transacting instantly.

Step In To Financial Independence

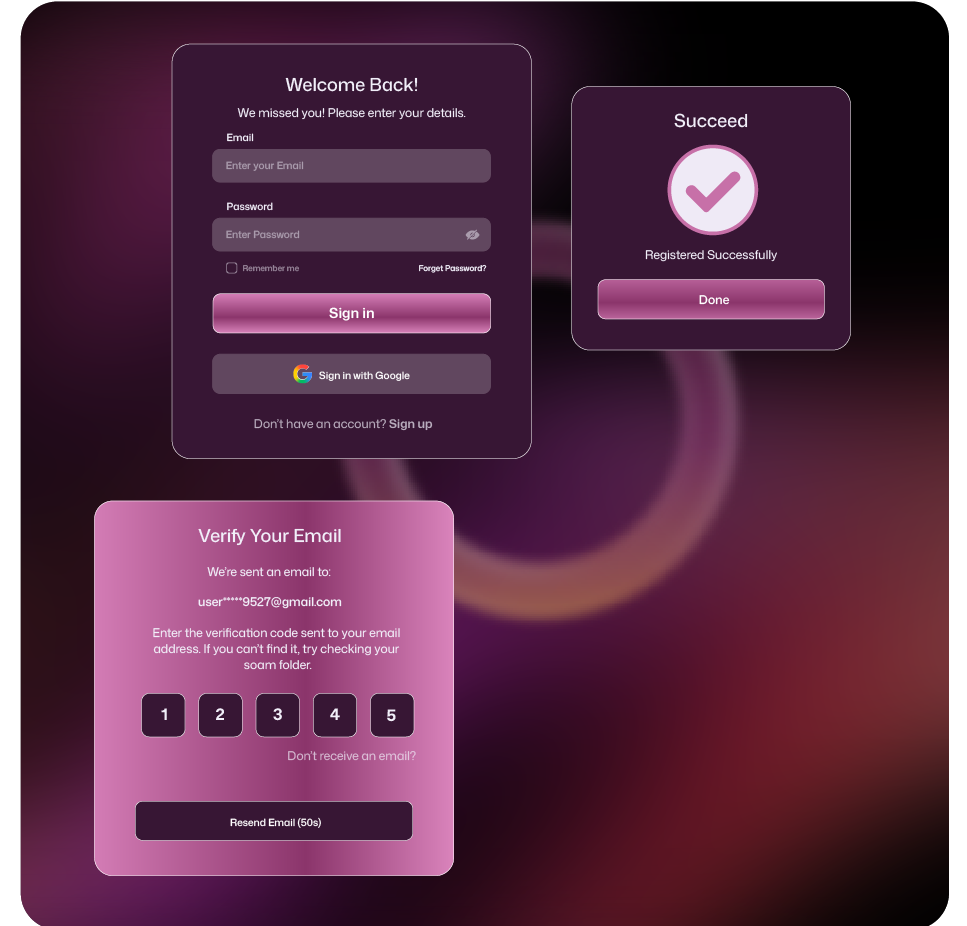

Easy Registration

Begin by signing up using your phone number, email ID, and necessary information. Our onboarding system ensures a smooth, secure process — guiding you through each step and verifying details instantly to get your business banking journey started.

Quick Verification

Once you complete registration, our representative will contact you to confirm and validate your business details. This quick verification process ensures your information is accurate, compliant, and ready for activation, helping you move to the next step.

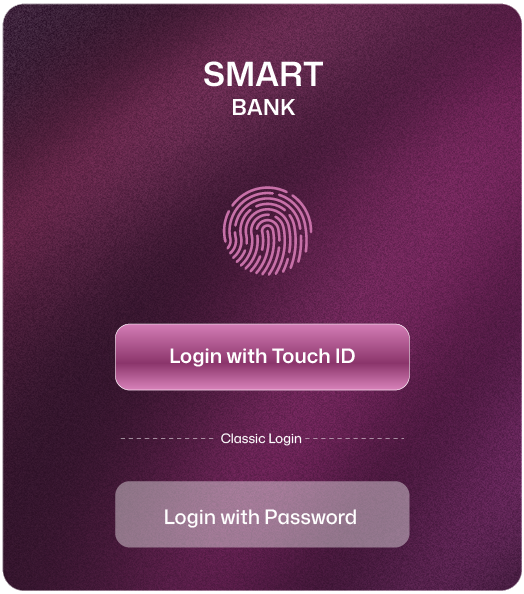

Account Activation

After successful verification, your Current Account will be activated and accessible through our secure dashboard. You can log in, track your transactions, and start managing finances effortlessly — giving you full control, visibility, and financial flexibility.