Case Validation

Start your escrow journey by defining and validating your business use case. Complete a simple digital checklist, and our experts coordinate directly with leading banking partners for review and approval. This ensures your escrow setup fully complies with financial regulations while aligning with transaction goals—streamlining the entire pre-approval process efficiently and securely.

Your Roadmap To Secured Settlements

Agreement Signing

Once your use case passes validation, proceed to formalize the escrow agreement. This step defines all parties, transaction conditions, fund release terms, and timelines clearly. We ensure every clause aligns with your business needs while maintaining full legal clarity, transparency, and accountability—establishing a solid foundation of trust before your escrow account goes live.

Account Setup

Experience a completely digital account-opening process through our partnered banks. We manage all coordination, document verification, and backend processing, saving you time and effort. With no need to visit a branch, you can set up your escrow account remotely—ensuring compliance, operational readiness, and convenience from the comfort of your workspace.

System Integration

Connect your escrow account effortlessly through our secure API suite. Enable automated fund flows, conditional approvals, and real-time monitoring with complete visibility. Our integration framework ensures compatibility with your existing systems, empowering you to manage escrow operations easily while maintaining control over every transaction across.

Go Live

After successful verification and testing, your escrow account is ready to go live. Begin real transactions instantly with predefined conditions ensuring every payment, settlement, or fund release happens automatically. Enjoy enhanced visibility, improved trust, and effortless control—making financial operations transparent, traceable, and perfectly aligned with your business.

Automating Finance With Absolute Precision

Step 01

Instant Transfers

Experience instant disbursals powered by advanced APIs designed for speed and reliability. Eliminate delays in vendor, employee, or customer payouts—funds move in real-time, boosting satisfaction and operational flow. With instant settlements, your business stays agile, efficient, and always ahead in delivering a superior financial experience that builds long-term trust.

Step 02

Compliance Simplified

Stay worry-free with built-in regulatory compliance that adapts to every transaction. Our escrow-backed framework ensures all fund movements meet legal standards effortlessly, minimizing audit risks. Manage KYC, fund verification, and settlement checks seamlessly—so your business remains fully compliant, transparent, and secure without added administrative stress.

Step 03

Dynamic Routing

Optimize payout performance through intelligent multi-bank routing technology. Our system automatically chooses the fastest, most reliable banking channel to process your payments. This reduces downtime, improves transaction success rates, and enhances liquidity—offering uninterrupted financial operations and a superior disbursal experience that scales with your business.

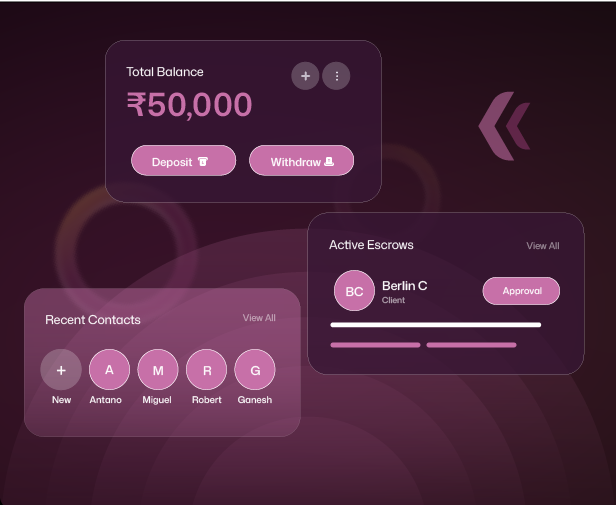

Managing Every Transaction With Precision

Stay updated with instant alerts for every transaction movement. From deposits to fund releases, our system keeps all stakeholders informed through smart notifications enhancing communication and reducing approval delays.

Our escrow solution enables seamless coordination between buyers, sellers, and intermediaries. Each party can view transaction status, authorize releases, and monitor settlements securely building accountability and reducing disputes.

Get access to live analytics that reveal transaction patterns, timelines, and performance metrics. Our escrow system translates financial data into actionable insights, empowering you to make informed business decisions and optimize fund management.

Every transaction within our escrow system is recorded with time-stamped precision, ensuring full traceability from initiation to completion. This immutable audit trail enhances accountability, simplifies financial reviews, and ensures compliance.